When RSU’s vest, a common question is what do you do with the stock. Do you keep them to stay invested in your employer? Are there any tax reasons to stay invested? Are there any investing reasons to hold onto the stock?

We’ll see below that selling your stock after RSU’s vest is often the recommended action. We’ll review the common questions surrounding this, and we’ll look at one exception.

Table of Contents

Selling to cover taxes on the vest date

When RSU’s vest you often do need to sell some of your stock to cover your tax bill.

When you receive an RSU grant from your employer, nothing happens tax wise. When the RSU’s vests, you are treated as having received compensation. At that point, you owe ordinary income tax and payroll tax (Medicare and Social Security) on the value of the stock on it’s vest date. (You can read my explainer on RSU’s here if you’d like)

Keep in mind though that if your RSU/equity compensation is less than $1 million, your employer will withhold 22% of your vested RSU amount for taxes. In practice, that means your employer will withhold 22% of the stock amount and sell it to pay taxes.

If you’re federal income tax rate is more than 22%, you’ll owe additional taxes. In 2022, the 22% tax bracket for single filers is $41,776 to $89,075. If you make any more than that, you’re going to owe more than your employer withheld.

Unless you have income or cash from other sources, that means you need to sell vested stock to pay the extra tax.

So, answer number 1 is: yes, you usually need to sell some stock as your RSU’s vest for tax purposes.

Should you sell the rest, too?

After selling some RSU-vested stock to cover your tax bill, should you sell the rest of it too? Or hold it long term?

As we’ll see below, it often doesn’t make sense tax-wise, investment wise, or financial planning-wise to keep your stock after the RSU’s vest.

Though there is one exception, which we’ll see below.

Are there tax advantages to holding stock?

You may wonder if there is a tax advantage to hold onto stock from vested RSU’s. After all, if you hold it for a year plus one day you can sell it and pay long term capital gains taxes instead of higher ordinary income.

Let’s compare two examples to see if there’s any tax advantage. Let’s say you just had $100,000 in RSU’s vest. So now you have $100,000 in stock. You owe federal income tax and payroll tax on that. Let’s assume it’s about $39,650. So your net is about $60,350. Your basis in the stock would be $100,000. If you held onto the stock you’d pay captial gains taxes on any

growth above the $100k.

If instead of stock you received $100,000 in cash you would still have to pay the same amount of tax. You could use that money to buy your employer’s stock and the situation would be the same. You’d have $100,000 in stock with $100k in basis. Any growth above that would be capital gains.

So, receiving stock from vested RSU’s is no different tax-wise than receiving cash, paying the tax, and buying the same amount of stock.

Either way, if you held onto the stock you’d pay the same amount of capital gains tax whenever you sold.

In summary, just to be clear, there’s no real tax advantage to holding onto stock from vested RSU’s. Especially when you see it’s the same as being paid cash and buying the stock outright.

Selling for investment reasons

When you think about your RSU’s, you should think about them in the context of your overall investment portfolio and strategy. And if you don’t have an overall investment strategy, you definitely should!

Think of it this way. Whatever your age, you need to have an investment strategy that has a return-to-risk profile that suits your personal needs. That means asset allocation, diversification and income distribution needs.

If you collect enough stock from RSU’s, you’ll get a concentrated stock position. That not only throws off your overall strategy, it’s quite risky.

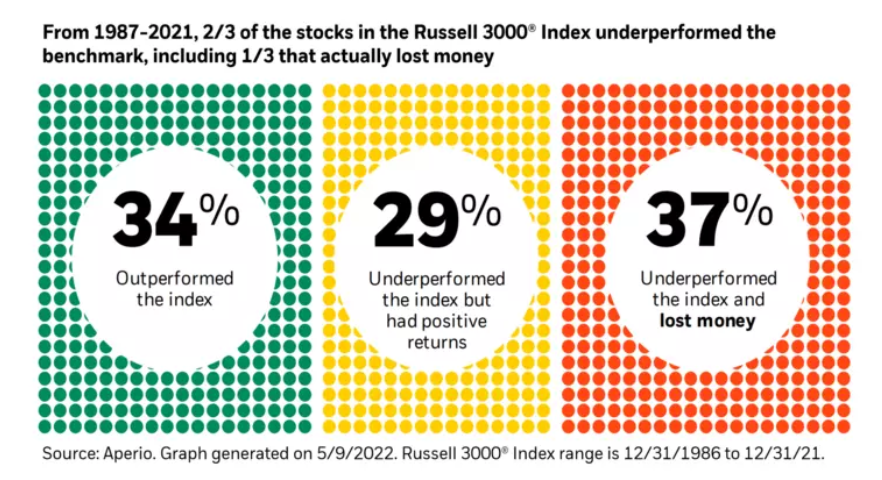

According to Blackrock, in the 35 years between 1987 and the end of 2021, 2/3rds of the stocks in the Russell 3000 index underperformed the index.

So, unless you deeply believe in your employer’s stock returns and you’re willing to take that risk, it makes sense to sell your RSU-vested stock as it vests and invest the funds according to your overall strategy.

Selling to fund your goals

When you sell the stock, it helps to consider your short, medium and long term goals. Investing funds for retirement is fine as long as those are funds you won’t touch in the next 3 to 5 years, at least. Probably longer. But you should consider your other goals.

Think about your short term goals. Maybe you want to save for a house, get married, or build an emergency fund. For this bucket of goals it might make more sense to keep this in cash, or maybe short term bonds, or a bond ladder. That way they stay liquid, accessible and you aren’t taking market risk.

While you often hear about “retirement planning”, you might consider instead “financial independence”. That means not stopping work altogether, but being free to do what you want. Maybe you’re tired of the corporate grind and want to start your own business. In that case, maybe your funds aren’t invested in the stock market but more conservatively to fund your future business.

All of that is an aside. The idea is that you should think of your RSU’s as a way to funds your short and longer term goals. Think of what’s important to you, when you would need to use the cash, and invest (or not invest) accordingly.

What if you have ISO's and RSU's?

One situation when you might want to hold onto RSU shares is if you have both Incentive Stock Options and RSU’s.

If you have been granted Incentive Stock Options, you are going to need to give your employer cash in order to exercise the options. Sometimes an employer will allow you to surrender stock that you already have to exercise the options.

In the example above, we assumed you have $100,000 in RSU’s vest and you paid $39,650 in taxes, leaving you with $60,350 in company stock. If you have an ISO that would cost you $50,000 to exercise, some companies will allow you to surrender $50,000 of company stock to exercise the options.

This is sometimes called a “stock swap”. It’s a good way of exercising an employee stock option without giving over cash. These tend to be a good option if the stock option are “in the money”, you’re bullish on the company but you want to avoid having too much concentrated stock position.

RSU's in a falling market

I sit here in October 2022 when the stock and bond market has been falling all year. There are going to be times like this. Stocks and bonds don’t always go up. Does that change what you should you do with your RSU’s?

In the end I’m not sure that it does. Above we saw the stats from Blackrock showing the “lottery-like” returns that single-stock positions have. They’re risky, as we’ve said. So even with a falling market it still makes sense to diversify your investments. You can hope the market rebounds, but as we’ve seen it’s better to have a diversified portfolio than a concentrated one.

If you were hoping to fund shorter term spending needs with the RSU’s, you still probably want to sell them, but you also have some planning questions to consider. Should your spending goals be changed or funded some other way? Should you save the funds in shorter-term, liquid investments like bonds?

Conclusion

At the end of the day, selling your RSU-vested stock usually is the best recomendation. What you do with the funds depends on your goals and planning needs.