Qualified Small Business Stock (QSBS) is a powerful tax benefit that allows you to exclude gain on the sale of a business interest. It’s a single section of the tax code, but it is deceptively complex.

We’ll cover two main topics:

- The rules that determine who qualifies and limitations to the benefit.

- Planning ideas for how to maximize the benefit for your situation.

Table of Contents

Benefit of Section 1202: Save Big on Taxes!

Keeping it high level, here’s the benefit of Section 1202 (Qualified Small Business Stock): if you sell stock in a “qualified small business”, you can exclude from capital gains taxes the greater of (i) $10,000,000 or (ii) 10 times the adjusted basis of the qualified small business stock.

There’s a couple of ways to think about this. The first part is the $10,000,000 exemption. If you founded a company in your mother’s garage and year’s later you sell it for millions, you can exclude up to $10 million of the gain. Basis in the stock of the company you founded is most likely zero. So if you sold the company for $10 million, you could exclude all the capital gains! Not bad, right?

Sometimes this section is called an exclusion for “founder’s stock”. But it’s not just about that. The second part says you can exclude up to 10 times the basis in the stock. This comes into play when the company has investors. For example, an LP of a Venture Capital fund or other investor that invested in the company would be able to use this exclusion too. If a partner of a VC fund invested $1 million, the LP could exclude up to $11 million of gain, 10 times the LP’s basis in the stock.

The benefit is per taxpayer and per business. If the VC investor invested in three companies that did well, he could use it for each one.

Rules to Follow

There are a number of rules to follow to qualify for this benefit. While we won’t go over every detail, her are the highlights.

Have to use a C Corporation

First, the stock has to be stock that was originally issued from a C Corporation in exchange for cash or as compensation for services.

Let’s break that down.

“Originally issued” means you got the stock directly from the company (or through the underwriter). You can’t buy the stock from a shareholder or someone else.

So, you can imagine these scenarios:

- You founded a start up as a C Corp and hold its stock.

- You are an employee of the company and received stock as compensation.

- You are an investor and purchased stock from the company through an investment.

Often, though, people start companies as LLC’s when they have more expenses than income. If the LLC is taxed as a partnership and you convert the LLC to a C Corporation, you could potentially use 1202 against the newly issued C Corp stock when you sell it later. Note you have to hold the new C Corp stock for 5 years, but we’ll talk about that later.

Warning: if your start up is an S Corporation, you can’t convert it to an C Corporation and use the 1202 exclusion. That’s because the stock was issued by the S Corporation originally. The only workaround here is distributing the assets from the S Corporation to a newly formed C Corporation.

Issuance date / 5 year holding period

Before you can get the big capital gain exclusion, you have to hold onto the stock for at least 5 years.

The start date for the 5 year period is called the issuance date. This date is important because it can change the exclusion you get.

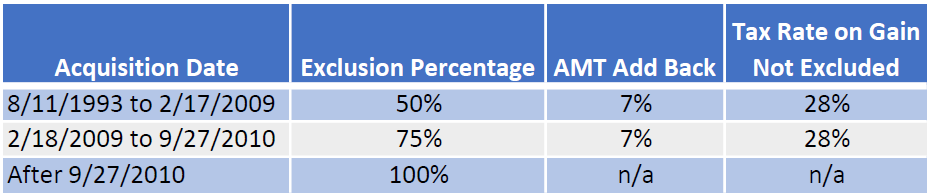

Take a look at these date ranges. If you received your stock after September 27, 2010, you can exclude 100% of your gain up to $10 million. But if you received your stock in either of the two prior date ranges, you may only exclude 75% or 50% of your gain. Plus, in either date range before 9/27/2010 you have to pay a tax (28%) of the amount you didn’t exclude. And there’s an add back to AMT, so you might end up paying AMT as well.

But if you’ve received your stock since September 28, 2010, you won’t have the AMT add back or have to pay the 28% tax.

$50 Million Asset Test

Another test is an “asset test”. Basically, before and immediately after the issuance of the stock the company can not have more than $50 million in assets. “Assets” refers to cash and the adjusted basis of property held by the company. A company can have self-created intangible assets and not run afoul of this rule. In fact, the Lyft company represented to investors that it was a Section 1202 QSB during its Series B funding round, yet had an estimated post–Series B valuation well in excess of $50 million.1 That’s because technology start ups can have few physical assets, but still be valued highly.

The $50 million assets test isn’t the same as valuation.

Qualified Trade or Business

One other test refers to the types of businesses the company can be in. The list of acceptable business is defined by exclusion. The industries the company CAN’T be in are:

- Professional services businesses such as law, accounting, health, engineering, or financial services or any business where the main asset is a person’s skill or reputation.

- Banking, insurance or investing.

- Farming

- Business like oil, gas or any kind of mineral extraction

- Operating a business like a hotel, restaurant or motel.

Where does that leave us? The emphasis (so says the IRS) are businesses that manufacture assets or deploy intellectual property to add value for customers. Technology startups easily qualify.

How to Magnify Sec. 1202's Benefit

The IRS has said that every taxpayer can use Section 1202 to exclude gain. But does that mean you are limited to just $10 million or 10 times basis? There might be some ways to “magnify” the benefit.

One warning here is that there aren’t any cases or regulations on Section 1202. So, use caution and make sure to speak to a tax professional.

$10 million exclusion vs. 10x basis

Section 1202 says the $10 million exclusion is only good one time per issuer, per company. So you can use the $10 million exclusion in a year and you can’t use it again for that same company stock.

But, the 10 times basis rule can be reused each year. That gives rise to a planning idea. Let’s say you have zero or low basis QSB stock and also some higher basis QSB stock. If you have an opportunity to sell the stock in multiple years, you would want to sell the low/zero basis stock first using up the $10 million dollar limit. If you had an opportunity to sell the rest of the stock the following year you would want to sell the higher basis stock at the 10 times basis limitation.

Trusts

There’s an exception to the rule that says you need to receive 1202 stock directly from the company. You can also receive 1202 stock via gift or death. Taking gift first, imagine a situation where you have used up your $10 million gain exemption for 1202 stock but you still have more gain beyond that that you can’t exclude. What you can do is gift the remaining 1202 stock to a trust. And the trust can use a 1202 exemption itself.

Non-grantor trusts are typically the best option for this kind of trust planning. That means an irrevocable trust or something like an ING (irrevocable, non grantor trust) set up in Nevada or Delaware. These are called NING or DING trusts. (If you want to read about NING/DING trusts, here’s an article.)

Be careful about setting up too many trusts. If you have three kids, you might want to only set up one trust for each and maybe also one for your spouse. But don’t set up multiple trusts for each kid thinking you can maximize the exemption. The IRS might find them duplicative.

Other gift planning ideas here include gifts to a Charitable Remainder Trust, gifts to a non-grantor Charitable Lead Trust, or gifts to a Spousal Lifetime Access Trust.

(Side note: straight gifts of 1202 stock to a spouse might not work. There’s debate on that part.)

Rollovers to another Qualified Small Business

Let’s say it’s 4 and a half months into your 5 year holding period and someone offers you a ton of money for your 1202 stock. What to do? You haven’t reached 5 years yet so you won’t be able to exclude you gain.

Section 1045 says you can rollover the 1202 stock you sold to a new 1202/Qualified Small Business and not recognize the gain. In our example, your 4.5 year holding period will be tacked onto the new QSB stock. You could conceivably hold onto the new QSB stock for another 6 months and take the $10 million exemption then.

Warning: you could set up another Qualified Small Business to do this, but it has to be legit. It can’t be a shell company that would just sit on the money. The new business has to be a real, active business or else the IRS might not recognize the rollover or exemption.

Using the 10x Basis Rule

The $30 million meets the 5 year rule but the new $4 million in ISO’s if you exercised them does not.

If you sold only the $30 million and didn’t exercise the ISO’s, or if you exercised the ISO’s and waited the required time to sell the stock, you’d be limited to the $10 million exclusion.

But there’s a work around. If you exercised the ISOs and immediately sold the stock (in a disqualifying sale), your basis in the stock would be $4 million. You would instead be limited by 10 times the basis of this new stock, or $40 million.

You could exclude the full $30 million, instead of the only $10 million. You’d still not be able to exclude capital gains on the $4 million you sold.

This works because the 5 year rule only tells you which stock you can exclude, but the 10 times basis rule only says it is 10 times the basis in QSB stock not 10 times basis in stock you can exclude.2

Conclusion

Now that the exemption rate for QSBS is 100% for stock received after September 27, 2010 Section 1202 is much more attractive. With careful planning you can avoid a great deal of taxes. But Section 1202 is deceptively complex, so careful planning and advice is needed.

- See: 120 Columbia Law Review 29-42

- See: Tax Notes Federal, July 20, 2020.