Restricted Stock Units (RSU’s) are a fairly simple concept. Your employer gives you a unit and if you stay employed long enough the unit turns into a share of the company’s stock. However, it’s important to understand how they are taxed. If you don’t, and without the proper planning, you can end up with a surprise come tax time.

Table of Contents

Restricted Stock Units vs. Restricted Stock

It’s easy to get Restricted Stock Units (RSU’s) and Restricted Stock confused. They sound similar. Here are the differences.

Restricted Stock:

If you’re granted Restricted Stock the company actually issues you a share of stock. It’s “restricted” in that you are not allowed to sell the stock for a period of time. During this time, the stock has what the tax code calls a “substantial risk of forfeiture”. That means if you leave before the period of time is up, you lose the stock.

Once that period of time is over, the restricted stock is “vested”. Meaning, it’s yours and you can sell it or keep it if you leave. Generally you get taxed only when the stock vests.

RSU’s:

With a RSU, you aren’t granted stock. You are granted a “unit”. The IRS calls a restricted stock unit an “unsecured, unfunded promise to pay cash or stock”. Economically, it’s the same thing as a restricted stock. You can’t trade the unit or do anything with it until it vests.

When it vests, you receive a share (or shares) of stock. If you leave before then, you lose that unit. If you stay employed for the requisite period of time, the unit becomes a vested share of the company stock. You can sell it or keep it if you leave. You get taxed only when the unit vests.

Comparing RSU’s and RS’s:

While both of these sound very similar, there are a few differences.

From the point of view of the company, granting a RSU means no stock is issued on the grant date. From an accounting perspective, that means there are no additional outstanding shares for the company to account for. An RSU is more like phantom stock.

From a tax perspective, there is one big difference. For both RSU’s and Restricted Stock, you are only taxed when the stock or unit vests. For Restricted Stock, Section 83(b) allows you to be taxed on the grant date when you receive the unvested stock. That can save you money, but Section 83(b) doesn’t apply for RSU’s.

How RSU's are taxed

When you receive a RSU, you don’t pay any tax on the grant date. Remember, there’s still a “substantial risk of forfeiture” until the RSU vests. You don’t pay taxes on the RSU until the risk that you may forfeit the stock lapses.

RSU’s vest either gradually over time, or suddenly using a “cliff” schedule. For example, a gradually vesting schedule may vest 25% a year until your entire grant vests. A cliff-vesting schedule is where the entire grant vests at once after a period of time. Many variations are possible.

As the RSU’s vest, the value of the stock on that day will be reported as compensation income and will end up on box 1 of your W-2. That means you pay ordinary income tax and payroll tax (i.e. Medicare and Social Security tax) on the vested RSU amounts.

You calculate the tax by multiplying the number of units that vest by the closing price for the company stock.

Example:

Let’s see an example.

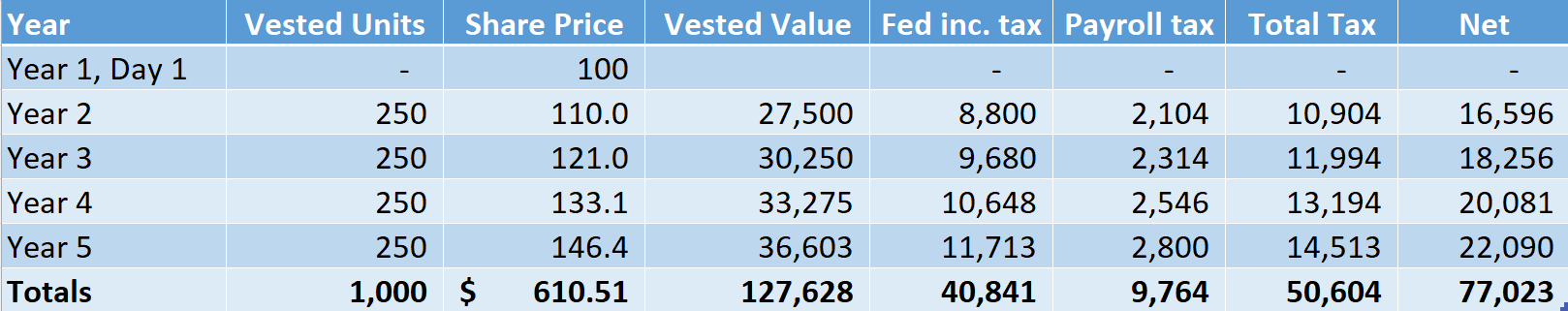

Assume your employer grants you $100,000 in RSU’s. The stock price is $100, so you get 1,000 units. To keep it easy, we’ll assume the stock grows at 10% annually and the RSU’s vest at 25% per year. We also assume you’re federal income tax rate is 32%. Here’s how the tax situation would look:

In this example you get 250 vested units a year, multiplied by the share price, gets you the total vested value. You multiply the 32% federal income taxes and payroll taxes against this and that’s your annual tax.

In total you end up receiving $127,628 in stock after they’ve all vested. You owe about $50,000 in taxes over 4 years. After taxes, you net about $77,000.

Withholding

One question you should be asking is how you’re going to pay all these taxes. After all, you’re receiving stock not cash. Well, the IRS requires employers to withhold income taxes and payroll taxes on income from vesting RSU’s.

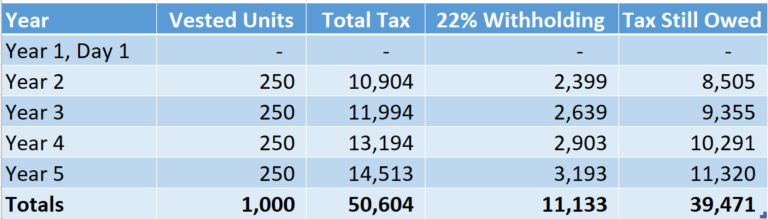

The IRS calls this “supplemental withholding”. For RSU-related income of less than $1 million, your employer will withhold 22%. In the example above since you are in the 32% tax bracket you will still owe some money at the end of the year.

Continuing the example above, you owed $50,604 in total taxes and your employer withheld 22% or $11,133. You still owe $39,471 in taxes.

To make up the difference, you’ll either have to pay the difference on April 15th next year or pay quarterly estimated taxes throughout the year. If you don’t pay enough throughout the year, you may have to pay a tax penalty.

You may have to pay a tax penalty if you don’t pay:

- at least 90% of your taxes throughout the year via withholding or estimated taxes,

- 100% of the tax owe from the prior year, or

- you end up owing more than $1,000 in tax after subtracting their withholdings and credits,

So, if your employer withholds only 22% and you’re in a high tax bracket you’ll have to make up the difference or you will end up paying a tax penalty later.

Estimated taxes are due throughout the year on these dates: April 15th, June 15th, September 15th and January 15th in the next year.

There are a few ways the companies handle withholding, but the most common is where your employer withholds enough stock on the RSU’s vesting date and sells the stock to cover your taxes. Remember, that may only be enough (at 22%) to cover your federal income tax and payroll tax (i.e. Medicare and Social Security taxes).

State taxes and dividends

Dividends:

Unlike with Restricted Stocks, holders of RSU’s do not receive dividends when the company issues dividends to its shareholders. Some companies do issue “dividend equivalents” to RSU holders. If you get a dividend equivalent, you get credited with that amount. For example, if you have 1,000 RSU’s and the company issues a $0.50 dividend, you would get credited with $500.

Some companies pay dividend equivalents out as additional RSU’s when they vest, some companies pay them out as cash when the RSU’s vest, and some pay them out as cash when the dividends are issued. Your RSU grant agreement will tell you how your company does it.

State taxes

Some states also make you pay state income taxes. In California the top margin tax rate for 2022 is 13.3% and the supplemental withholding rate on equity compensation is 10.23%. So again, for California residents you still may have to make up the difference if you are in the higher tax brackets.

Capital Gain Taxes When You Sell

Once the RSU’s have vested, the stock is now yours. If you sell the stock in one year plus a day, you pay long term capital gains taxes.

- For Federal taxes, long term capital gains taxes are 23.8% (top rate) less your basis in the stock. Your basis in the newly vested stock is the amount of compensation income you recognized, which is in Box 1 of your W-2.

- For California residents, the state doesn’t recognize ciapital gains taxes. You pay ordinary income taxes again when you sell the stock, less the stock’s basis.

Conclusion

While RSU’s may seem fairly easy in concept, the tax details are important to keep track of. With proper financial planning and tax planning you can keep from being surpirsed come tax time!