If you own a primary residence, you receive a number of tax benefits. Mortgage interest deductions. Capital gains tax exclusion when you sell the home. Do you get the same benefits for your vacation home?

In this article we will review some of the tax benefits available to you for your vacation home.

Mortgage interest deduction

Tax Code section 163(h) gives us the mortgage interest deduction. It says a taxpayer has a deduction for interest on debt incurred in “acquiring, constructing, or substantially improving any qualified residence of the taxpayer”.

A qualified residence is (a) your principal residence and (b) one other residence of the taxpayer which you select to be used for the mortgage interest deduction and which you use as a residence.

So, you can deduct interest on debt used to acquire your primary home AND on a second home (i.e. vacation home).

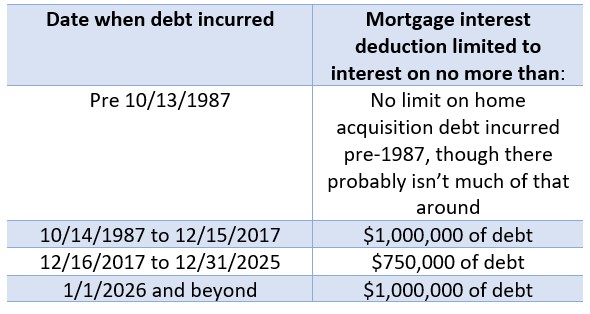

Limits on the deduction depend on when you took out the mortgage:

So, if you have a primary home and buy a second home, you can deduct interest on both mortgages on Schedule A of your tax return. But the deduction is limited to interest on debt of no more than $1 million or $750,000, depending on when you bought the property. (IRS Topic 415: Renting Residential and Vacation Property).

Renting Vacation Property

What if you rent out your vacation home for part of the year? Can you still deduct mortgage interest? Well, it depends on how often your rent it and how often you live in it.

Situation 1. Rent infrequently.

If you rent out your vacation home for less than 15 days in a year, the house is considered a personal residence.

You can deduct your mortgage interest (beneath the above limits) as an itemized deduction. You also don’t need to report rental income so long as it’s only for less than 15 days a year. Since it’s a personal residence you can’t deduct rental expenses either.

Situation 2. Use infrequently.

If you use the secondary home for no more than the greater of 14 days a year, or, 10% of the total days it is rented to others, and you rent the property 15 days or more, it is a rental property.

You must report rental income on your tax return, typically on Schedule E. You can deduct expenses, including mortgage interest, against the rental income. If you have a net loss, you can’t deduct that loss against your other income unless you qualify as a real estate professional. (That’s a topic for another article.)

Situation 3. Rent some and use some.

If you use the secondary home for more than the greater of 14 days a year, or, 10% of the total days it is rented to others, you must divide your expenses between time spent as a rental and time spent for personal use. Rental income needs to be reported as well.

If your rental expenses exceed your rental income, you may be able to carry your unused rental expenses forward. You may still be able to deduct the personal portion of your rental expenses on as an itemized deduction.

Capital Gains Exemption

Homeowners get an exemption from capital gains taxes when selling their homes ($250,000 or $5000,000 if married filing jointly). Usually this applies to your primary residence, but not your vacation home.

To get this exclusion you have to meet a two part test.

First, you have to have owned the property for at least 24 months of the 5 years leading up to the sale. If you’ve owned the property for a while, that’s usually not the problem.

Second, you have to have used the property for at least 24 months of the previous 5 years. The 24 months doesn’t have to be in one block of time. For married couples, each spouse must meet the residence requirement individually to get the full $500,000 exclusion. If you only occasionally stayed at the property you’d have trouble proving this exclusion for your vacation home.

1031 Exchanges

Even if you’ve used the rental property occasionally for personal uses, you may be able to qualify for a tax-free exchange (i.e., section 1031 exchange) of one piece of property for another. Here’s how that works.

Under Section 1031, no gain or loss will be recognized on the exchange of property held for productive use in a trade or business or for investment (relinquished property) if the property is exchanged solely for property of like kind that is to be held either for productive use in a trade or business or for investment (replacement property).

So, if you exchange an investment property for another investment property, you won’t recognize capital gains on the exchange.

Various courts have said holding a vacation home hoping it will go up in value so you can sell it later for a gain doesn’t count as an investment property. So, what do you have to do to get Section 1031 treatment for a vacation home?

Here’s how. You must have owned your property for 2 years prior to the exchange. During that period, you have to have rented the property for at least 14 days during each of the 2 years. Each year you CAN NOT use the property for personal uses for more than the greater of 13 days or 10% of the number of days you rented it. Then, you have to do the same for the property you receive. (See IRS Revenue Procedure 2008-16 for the details)

Property Tax Deduction

The Tax Cuts and Jobs Act put a limit on the amount of property taxes and sales taxes you can deduct at no more than $10,000.

For California residents, the state legislature recently enacted a “workaround” to the SALT tax limit. Like many other state workarounds, Assembly Bill 150 (AB 150) essentially moves an individual taxpayer’s tax liability to the level of a business entity and gives the taxpayer a corresponding tax credit.

AB 150 applies to taxpayers who are a member/shareholder of a pass-through entity that does not have a partnership as an owner, is not part of a combined group, and is not a publicly traded partnership. It could be a partnership, LLC or S-Corp.

For tax years beginning on or after January 1, 2021, and before January 1, 2026, a qualifying entity (defined above) makes an election to pay an annual 9.3% tax on owner’s share of net income. The owner then gets a nonrefundable credit against their California income tax liability. In addition, the pass through entity can deduct the 9.3% tax on its federal tax return.

This is a new law and some issues have been pointed out by practitioners. One is that the credit doesn’t apply against an individual’s state tentative minimum tax. The result is you may end up paying more by electing this treatment. Individuals who are curious about this new rule should contact their tax professional and have them run an evaluation to determine if this makes sense for you.